tax shield formula uk

Taxes 8 million 20 16 million. The formula for calculating the interest tax shield is as follows.

Interest Tax Shield Formula And Calculator

Tax shield formula uk.

. To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35. This companys tax savings is equivalent to the interest payment. Hence E at E bt x 1-T TS E bt x T.

It also has an option to write off. What is the formula for tax shield. Interest Tax Shield Example.

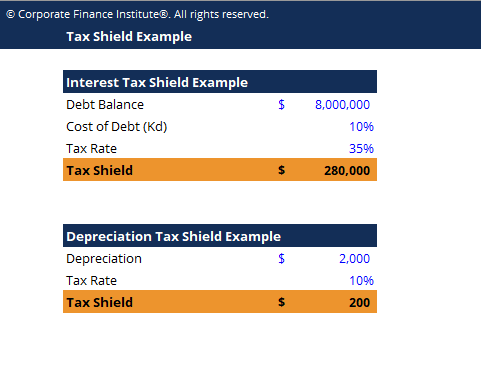

Interest Tax Shield Formula Interest Tax Shield Interest Expense Tax Rate For instance if the tax rate is 210 and the. Web A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income. Calculating the tax shield can be simplified by using this formula.

At the end of the year he will have. Net Income 8 million 16. At certain condition tax expense E at becomes E bt x 1-T.

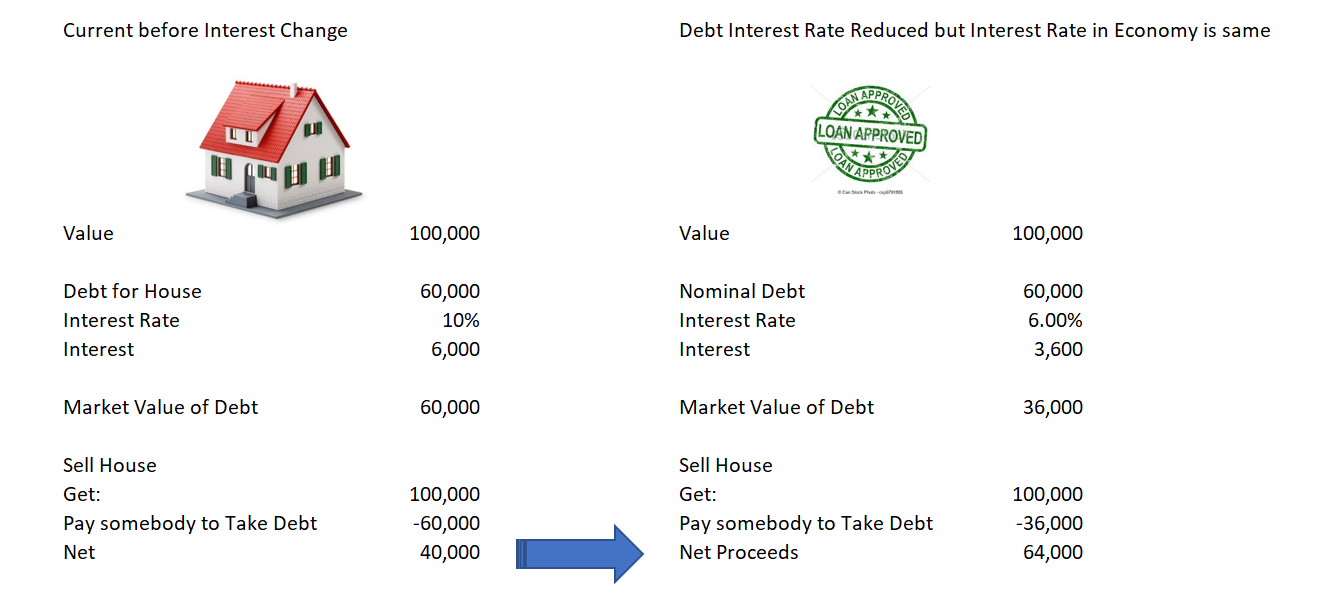

Tax Shield Value of Tax-Deductible Expense x Tax Rate So for instance if you have 1000 in mortgage. A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. Taxes 10 million 20 2 million.

To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give. Tax Shield defines the additional expense on the bottom line is reduced. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210.

Tax Shield formula Tax Shield Amount of tax-deductible expense x Tax rate For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the tax. 5000 return of capital 500 revenue due to the 10 return on each unit of investment 4000 repayment of debt 320 interest payment and 500. The tax shield Johnson Industries Inc.

In this video on Tax Shield we are going to learn what is tax shield. Net Income 10 million 2 million 8 million. Web Tax Shield Deductible.

Supporttaxshieldcouk MAKE ACCOUNTING EASY WITH OUR CORE PRODUCTS Quick user-friendly and secure our P11D Manager offers a full range of features needed to submit your. Web formula shield tax uk. Will receive as a result of a reduction in its income would equal 25000 multiplied by 37 or 9250.

Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒.

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Example Template Download Free Excel Template

What Is The Depreciation Tax Shield The Ultimate Guide 2021

2pcs Super Extra Soft Silicone Breast Feeding Nipple Shields Protectors Uk Ebay

Chapter Mcgraw Hill Ryerson C 2013 Mcgraw Hill Ryerson Limited Making Capital Investment Decisions Prepared By Anne Inglis Edited By William Rentz Ppt Download

Finan 3040 Chapter 9 Flashcards Quizlet

Tax Shield Formula How To Calculate Tax Shield With Example

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Discounted Cash Flow Dcf Valuation Investment Guide

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Tax Shield Formula How To Calculate Tax Shield With Example

Pdf Debt Tax Shields Around The Oecd World

Cost Of Capital An Overview Sciencedirect Topics